Social Smarts: How I Mastered the Art of Spending (And Still Saved)

Ever feel like your social life is secretly draining your bank account? You're not alone. Between birthdays, brunches, and last-minute trips, social spending can quietly spiral out of control. I used to dread checking my balance after a busy month of hangouts. But over time, I discovered a smarter way to enjoy meaningful connections without financial regret. This is how I turned social spending from a guilt trip into a strategic win. What began as a series of small realizations—about group dinners, weekend plans, and the pressure to always say yes—eventually became a complete shift in mindset. It wasn’t about cutting people out. It was about redefining what it means to connect, celebrate, and belong, all while protecting my financial future. This journey didn’t require sacrifice. It required strategy.

The Hidden Cost of Hanging Out

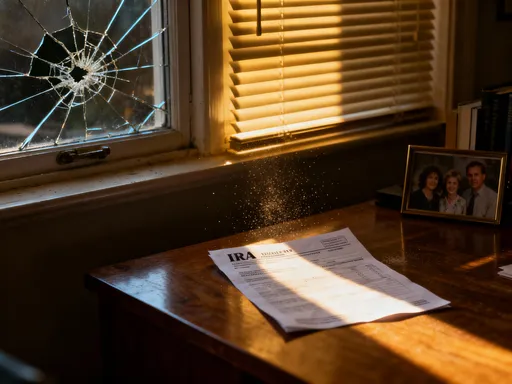

Socializing is often seen as a break from responsibility, a time to relax and unwind. Yet beneath the laughter and shared moments lies a financial current that many overlook. Every coffee meet-up, concert ticket, or spontaneous road trip carries a cost—not just in dollars, but in long-term financial momentum. The real danger isn’t any single expense, but the accumulation of small, seemingly harmless transactions that go unnoticed until the monthly statement arrives. What starts as a $15 lunch can evolve into $300 in unplanned spending by month’s end. The psychology behind this pattern is powerful. Humans are wired for connection, and social approval often feels more immediate and rewarding than delayed financial security. This creates a subconscious trade-off: emotional validation now for financial strain later.

The pressure to participate is real. In group settings, there’s an unspoken expectation to keep pace—whether it’s splitting a check evenly when one person ordered significantly more, or joining a weekend getaway that stretches your budget. The fear of missing out, or FOMO, amplifies this tendency. Saying no can feel like exclusion, even when the real risk is overspending. Emotional spending further clouds judgment. A stressful week might lead to an impromptu bar crawl with friends, not because anyone particularly wanted to go, but because it felt like relief. These moments are rarely about the activity itself, but about coping, bonding, or escaping. Recognizing this distinction is crucial. Once you see social spending not as inevitable, but as a series of choices influenced by emotion and peer dynamics, you gain the power to make different ones.

Consider the case of a monthly girls’ night out. What begins as a casual dinner at a mid-range restaurant can quickly escalate with drinks, appetizers, and dessert. Add in transportation and tips, and the per-person cost can exceed $75. Do this ten times a year, and it’s nearly $750—enough to cover a small vacation or a significant portion of an emergency fund. Multiply this across various social circles—work friends, college buddies, family gatherings—and the numbers grow rapidly. The issue isn’t enjoyment; it’s awareness. Most people don’t track social expenses separately, so they remain invisible leaks in an otherwise careful budget. The solution starts with visibility. Simply logging these costs for one month can be a wake-up call. From there, it becomes easier to set limits, choose alternatives, and protect your financial goals without feeling deprived.

Reframing Social Value: Experience vs. Expense

There’s a common assumption that the cost of an activity reflects its value. A $200 dinner at a trendy rooftop bar must be more memorable than a $20 picnic in the park, right? Not necessarily. In fact, research in behavioral economics suggests that the intensity of an experience often has little correlation with its price tag. What makes a moment meaningful is not the amount spent, but the quality of connection, the novelty of the activity, and the emotional resonance it creates. A game night at home, complete with laughter and friendly competition, can leave a deeper impression than a crowded club where conversation is nearly impossible. The key is shifting focus from consumption to connection.

High-cost social activities often come with trade-offs. Fancy restaurants may offer ambiance, but they limit conversation due to noise and pacing. Expensive concerts require long commutes, high ticket prices, and overpriced concessions, leaving little room for spontaneity or interaction. In contrast, low-cost alternatives frequently encourage more engagement. A potluck dinner invites collaboration and personal expression. A hike in a local nature reserve fosters presence and shared discovery. Free community events—like outdoor movie nights, art walks, or seasonal festivals—offer rich experiences without financial strain. These activities also tend to be more inclusive, allowing friends with varying income levels to participate fully without discomfort.

This isn’t about rejecting all paid experiences. There’s room for occasional splurges, especially for milestones or special occasions. The goal is balance—making deliberate choices rather than defaulting to the most expensive option. One effective strategy is to evaluate plans through a “value lens.” Before committing, ask: What will we gain from this? Is it the food, the location, or simply the time together? Often, the answer reveals that the core need is companionship, not consumption. When that’s clear, creative alternatives become not just acceptable, but preferable. A birthday celebration at home with homemade food and heartfelt toasts can feel more personal than a generic restaurant reservation. A weekend camping trip, while requiring some planning, offers adventure and bonding at a fraction of the cost of a luxury resort stay.

Over time, this mindset shift changes group norms. When one person starts suggesting meaningful, low-cost gatherings, others often follow. It sends a quiet message: our friendship isn’t measured by what we spend, but by how we spend our time. This redefinition of value doesn’t diminish social life—it enriches it. By decoupling connection from spending, you create space for authenticity, creativity, and sustainability. The result is not just financial relief, but deeper, more intentional relationships.

The Budget That Actually Works in Real Life

Traditional budgeting often fails because it treats social spending as a category to minimize or eliminate. This approach sets people up for frustration. Social connection is a fundamental human need, and attempting to cut it out entirely leads to resentment, isolation, or eventual blowouts. A better strategy is integration. Instead of fighting human nature, work with it. The most effective budgets aren’t rigid—they’re flexible, realistic, and designed for actual life. This means including social spending as a planned, non-negotiable category, just like rent or groceries. When you allocate funds for fun in advance, you remove the guilt and impulse that lead to overspending.

A successful social budget starts with clarity. Review your past three months of spending and categorize every social expense: meals out, events, gifts, travel, and incidental costs like parking or rideshares. Add them up to find your average monthly total. This number becomes your baseline. From there, decide whether it aligns with your financial goals. If it’s too high, set a realistic target—say, 10–15% lower—and adjust gradually. The key is sustainability. A budget that feels punishing won’t last. Instead, aim for consistency. One effective method is the envelope system, adapted for the digital age. Allocate a fixed amount to a separate account or digital wallet specifically for social activities. Once the money is gone, no more spending in that category until the next cycle. This creates natural boundaries without requiring constant willpower.

Technology can support this process. Budgeting apps like YNAB (You Need A Budget) or Mint allow you to track social spending in real time, set monthly limits, and receive alerts when you’re nearing your cap. Some apps even categorize transactions automatically, making it easier to stay aware. Another useful tactic is pre-commitment. If you know a friend’s birthday is coming up, set aside the gift money weeks in advance. For recurring events like monthly dinners, pay your share ahead of time to avoid the temptation to overspend in the moment. These small acts of planning reduce decision fatigue and prevent emotional spending.

Flexibility is equally important. Life is unpredictable, and social calendars change. A sudden invitation shouldn’t derail your entire budget. That’s why it’s wise to include a small “spontaneity buffer” in your social fund—say, 10–20% of the total. This allows for last-minute plans without guilt. If you don’t use it, roll it over to the next month or put it toward a savings goal. The goal isn’t perfection. It’s progress. By treating social spending as a planned, intentional part of your financial life, you gain control without losing connection. You stop seeing money as a barrier to fun and start seeing it as a tool for better choices.

The Art of Saying No (Without Being *That* Person)

One of the most underestimated financial skills is the ability to decline invitations gracefully. For many, saying no feels risky. It can trigger fears of judgment, exclusion, or damaging relationships. Yet learning to set boundaries is essential for long-term financial health. The good news is that it’s possible to protect your budget without alienating friends. The key lies in communication—how you say no matters more than the word itself. A thoughtful, respectful response can preserve relationships while honoring your priorities. In fact, many people appreciate honesty and may even feel relieved to know they’re not alone in managing expenses.

There are several effective ways to decline without causing friction. One approach is to express enthusiasm while citing a scheduling conflict. “I’d love to join the trip, but I already have plans that weekend” is neutral and avoids financial disclosure if you’re not comfortable sharing. Another strategy is to suggest an alternative. “I can’t make the concert, but I’d love to catch up over coffee next week” redirects the interaction toward a lower-cost option. This shows you value the relationship, just not at any price. For recurring events, like weekly happy hours, you can limit your participation. “I can’t do every week, but I’ll join every other Friday” sets a sustainable pace.

When appropriate, honesty can be powerful. Saying, “I’m focusing on my budget this month, so I’m being selective about spending” is direct and relatable. Most people have faced similar challenges. This kind of transparency can even inspire others to reflect on their own habits. It also reinforces your commitment, making it harder to backtrack. Over time, people come to expect and respect your boundaries. They stop seeing your “no” as rejection and start seeing it as responsibility.

Another useful technique is to frame your decision around values. Instead of saying, “I can’t afford it,” try, “I’m prioritizing saving for a home right now, so I’m cutting back on non-essentials.” This shifts the conversation from lack to purpose. It shows you’re not depriving yourself—you’re investing in something meaningful. People respond positively to intentionality. They may even admire your discipline. The more consistently you practice these responses, the more natural they become. Saying no doesn’t have to be awkward. With the right approach, it can strengthen your relationships and your financial foundation at the same time.

Upgrading Your Circle’s Financial IQ Together

Financial habits don’t exist in a vacuum. They’re influenced by the people around us. If your social circle routinely spends freely, it’s harder to stick to a budget. But rather than withdrawing, you can become a quiet leader in financial wellness. Small, consistent actions can shift group norms over time. The goal isn’t to lecture or judge, but to model better choices in a way that feels natural and inviting. When people see that you’re having fun while spending less, they become curious. That curiosity can open the door to change.

One of the most effective ways to influence your group is by hosting. When you plan gatherings, you control the budget. Instead of meeting at a restaurant, invite friends for a themed potluck. Ask everyone to bring a dish, and provide music or games. The result is a lively, personalized event at a fraction of the cost. For birthdays, suggest group experiences like a cooking class, trivia night, or volunteer activity. These create memories without the financial hangover. When planning trips, propose off-season dates, shared accommodations, or destination exchanges to reduce costs. By making these options enjoyable and well-organized, you demonstrate that value isn’t tied to price.

Technology can also be a group enabler. Introduce apps like Splitwise or Venmo to handle shared expenses fairly. This prevents awkwardness over uneven checks and builds trust. You can even start casual conversations about money—not as a taboo, but as a shared challenge. “I’ve been using this app to track my spending—have you tried anything like that?” opens the door without pressure. Over time, these small nudges create a culture of awareness. Friends begin to suggest budget-friendly options on their own. They become more mindful of costs when planning events. Peer momentum takes over, and what once felt like an uphill battle becomes a shared journey.

The benefits go beyond money. Groups that communicate openly about finances tend to have stronger, more honest relationships. There’s less resentment over unequal contributions and more appreciation for thoughtful planning. By leading with action rather than advice, you create a positive ripple effect. You don’t have to be the “money person” in the group. You just have to be the one who shows that smart spending and great times aren’t mutually exclusive.

Investing in Relationships, Not Just Spending on Them

True connection isn’t purchased—it’s cultivated. While spending money on others can feel generous, it’s not the only, or even the best, way to show care. The most meaningful relationships are built on time, attention, and effort—resources that cost nothing but are often more valuable than cash. A handwritten note, a home-cooked meal, or a phone call during a tough week can mean more than an expensive gift. These acts signal presence, not just participation. They show you see the person, not just the occasion.

Shifting from transactional to relational spending means redefining what it means to contribute. Instead of asking, “What should I buy?” ask, “How can I support?” This mindset leads to deeper bonds and fewer financial regrets. For example, instead of sending a $50 gift for a friend’s birthday, offer to babysit for a night so they can have a date with their partner. That gift of time may be more appreciated and remembered. Or, instead of going out for coffee, invite a friend for a walk in the park. The change of scenery and uninterrupted conversation often lead to more meaningful exchanges than a café setting.

This approach also reduces the pressure to perform. When relationships are based on spending, there’s an unspoken competition—keeping up with gifts, outings, and gestures. When they’re based on presence, the pressure fades. You’re no longer measuring your worth by what you spend, but by how you show up. This is especially important in long-term friendships, where consistency matters more than grand gestures. A monthly check-in call, a shared hobby, or a tradition like an annual hike become the foundation of connection. These rituals cost little but build immense value over time.

Moreover, non-monetary investments often lead to reciprocal generosity. When you give time or support, others are more likely to do the same. This creates a cycle of mutual care that strengthens the entire network. It also makes financial discussions easier, because the relationship isn’t transactional. You’re not keeping score—you’re building something lasting. By focusing on effort rather than expense, you create relationships that are both emotionally and financially sustainable.

Building Wealth Without Losing Your Social Life

Financial success doesn’t require social isolation. In fact, the opposite is true: strong relationships are a key component of long-term well-being. The goal isn’t to choose between wealth and connection, but to integrate them. Disciplined social spending isn’t about cutting back—it’s about spending with purpose. Every dollar saved through smarter choices becomes a dollar invested in your future. Over time, these small savings compound. $100 a month put into a retirement account at a 7% annual return grows to over $16,000 in ten years. That’s not just financial security—it’s freedom.

Reducing unnecessary social spending also lowers financial stress. When you’re not living paycheck to paycheck, you gain mental clarity and emotional resilience. You can handle emergencies, pursue opportunities, and plan for the future with confidence. This stability benefits your relationships, too. You’re less likely to feel resentment over money, more able to support loved ones, and better equipped to enjoy life without anxiety. Financial peace isn’t a solo journey—it radiates outward, improving every aspect of your life.

The best version of your financial life isn’t one where you say no to everything. It’s one where you say yes to what matters. By aligning your spending with your values, you create space for both connection and growth. You attend the events that bring joy, skip the ones that drain you, and find creative ways to celebrate life without overspending. You build a network that supports your goals, not just your habits. And you prove that financial discipline and social richness aren’t opposites—they’re allies.

In the end, it’s not about how much you spend on your friends, but how much you invest in them. It’s not about missing out, but about choosing in. A balanced life isn’t perfect. It’s intentional. It’s showing up—with your presence, your priorities, and your peace of mind. That’s the real win. Not just a growing bank account, but a life well-lived, shared with people who matter, and funded by choices you can feel good about. Because the smartest spending isn’t the least—it’s the most meaningful.