How We Built a Financial Safety Net for Our Newborn—And You Can Too

When our baby arrived, so did a wave of financial anxiety. Suddenly, every decision felt bigger—healthcare, education, emergencies. We didn’t have a six-figure salary, but we built a realistic, step-by-step system to secure our child’s future. This is how we balanced saving, investing, and protecting what matters most—without losing sleep. It’s not about perfection, but progress. We started with small changes, focused on consistency, and gradually layered protections that gave us peace of mind. This journey wasn’t about radical sacrifices or complex strategies. It was about clarity, discipline, and love—choosing to act early so our child could grow up in a home free from money-related stress. What began as fear transformed into purpose.

The Wake-Up Call: When Parenthood Changed Our Money Mindset

The birth of a child is more than a personal milestone—it’s a financial turning point. For many families, the arrival of a newborn shifts priorities in ways that are both emotional and deeply practical. Before our daughter was born, we managed our finances with a sense of flexibility. Unexpected expenses were inconvenient, but rarely catastrophic. That changed the moment we held her for the first time. Suddenly, the idea of being unprepared felt unacceptable. We began asking questions we had never considered: What if one of us couldn’t work? How would we cover medical costs if she got sick? Could we afford quality childcare without sacrificing long-term goals?

This shift wasn’t immediate. It came gradually, as we reviewed hospital bills, researched daycare costs in our area, and realized how quickly expenses could add up. The average cost of infant daycare in many communities exceeds $1,000 per month—a figure that rivaled our rent. Add in pediatric visits, formula or specialized feeding supplies, and baby gear, and it became clear that our previous budget no longer fit our reality. We weren’t alone. Studies show that the typical family spends between $12,000 and $15,000 annually on child-related expenses in the first year alone, not including housing or food. This wasn’t just a lifestyle adjustment; it was a financial recalibration.

What changed most was our attitude toward risk. Before parenthood, we viewed emergencies as rare disruptions. Now, we saw them as inevitable possibilities that required preparation. We realized that financial planning wasn’t a luxury or a distant goal—it was a responsibility. The emotional weight of parenthood brought a new clarity: security wasn’t about accumulating wealth, but about creating stability. This mindset shift became the foundation of our entire financial strategy. It wasn’t driven by fear, but by care. And from that care, we built a system designed not for wealth maximization, but for resilience.

Laying the Foundation: Building Your Core Financial Structure

Every strong financial system rests on three pillars: an emergency fund, adequate insurance, and a realistic budget. These are not glamorous tools, but they are essential. They form the base upon which all other financial decisions can safely rest. Without them, even well-intentioned saving and investing efforts can collapse under unexpected pressure. For us, building this foundation wasn’t about making drastic changes overnight, but about making deliberate choices that added up over time.

The first step was establishing a liquid emergency fund. We aimed for three to six months’ worth of essential living expenses—enough to cover rent, utilities, groceries, and basic childcare for half a year in case of job loss or medical leave. We didn’t start with thousands of dollars. Instead, we began with $500 in a separate high-yield savings account, then added small amounts each month. The key was consistency. Over 18 months, we reached $12,000. This fund wasn’t meant to finance vacations or upgrades—it existed solely for true emergencies. Knowing it was there reduced our anxiety and gave us breathing room to make thoughtful decisions, not reactive ones.

Next came insurance. We reviewed our health coverage and confirmed that our plan included pediatric care, vaccinations, and specialist visits without excessive out-of-pocket costs. We also evaluated life insurance, recognizing that if one of us were to pass away, the surviving parent would need financial support to maintain the household and care for our child. We chose term life insurance for its affordability and clarity—coverage for a set period at a fixed rate. Disability insurance was another critical layer. If either of us became unable to work due to illness or injury, this would replace a portion of our income. These policies weren’t pleasant to think about, but they were necessary safeguards.

Finally, we revised our household budget. This wasn’t about cutting out joy, but about aligning spending with our new priorities. We categorized expenses into needs, wants, and future goals. Dining out, streaming subscriptions, and weekend trips were reduced—not eliminated, but consciously limited. The money saved was redirected toward our emergency fund and future goals. We used a simple spreadsheet to track income and spending, adjusting it monthly. This process brought transparency and control. We weren’t restricting ourselves—we were redirecting resources toward what mattered most.

Automating the Future: How to Save Without Thinking

Willpower is unreliable. Life gets busy, emotions run high, and good intentions often fall by the wayside. That’s why automation became the backbone of our financial strategy. Instead of relying on discipline, we built systems that made saving automatic and nearly invisible. The goal was to remove decision-making from the equation so that progress happened consistently, regardless of our mood or schedule.

We started by setting up direct deposits from our paychecks. A portion of each paycheck went straight into our high-yield savings account before we even saw it. We also opened a dedicated account for child-related goals, such as future education and healthcare, and set up recurring transfers of $100 per month. These transfers were timed to occur right after payday, ensuring the money was allocated before it could be spent. Over time, this simple habit added up. In five years, without ever feeling a financial strain, we had saved over $6,000—just from consistent, automated contributions.

We also used technology to reinforce our habits. Banking apps that round up purchases to the nearest dollar and deposit the difference into savings helped us save small amounts effortlessly. For example, a $3.50 coffee purchase triggered a $0.50 transfer. It seemed insignificant, but over a month, these micro-savings totaled nearly $40. While not life-changing on their own, they contributed to a culture of saving—proof that progress was happening, even in the background.

Another powerful tool was employer-sponsored retirement plans. We increased our 401(k) contributions gradually, aligning them with pay raises. This “pay yourself first” approach meant we never adjusted our lifestyle to accommodate the extra savings—we simply saved the portion we hadn’t yet learned to spend. Over time, these automated systems reduced mental load and decision fatigue. We weren’t constantly debating whether to save; we just did. And that consistency, more than any single large deposit, became the engine of our financial progress.

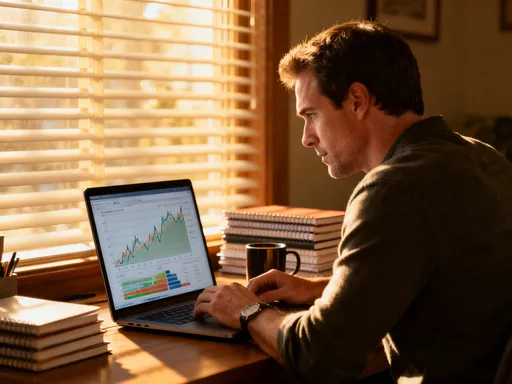

Investing with Purpose: Growing Wealth Without Gambling

Many people confuse investing with speculation. They imagine stock picking, market timing, or chasing high-risk opportunities in hopes of quick gains. But true investing is not about gambling—it’s about patience, discipline, and alignment with long-term goals. After our child’s birth, we shifted our investment approach from passive to purposeful. Every dollar we invested was assigned a role: to grow steadily, protect against inflation, and support future milestones like education and healthcare.

We focused on low-cost index funds, which offer broad market exposure and historically strong returns over time. These funds track major market indices like the S&P 500 and require minimal management. They also have lower fees than actively managed funds, which means more of our money stays invested. Research consistently shows that over decades, low-cost index funds outperform the majority of actively managed portfolios. We didn’t try to beat the market—we chose to stay in it, consistently.

To support our child’s future education, we opened a 529 college savings plan. These accounts offer tax advantages: contributions grow tax-free, and withdrawals are tax-free when used for qualified education expenses. We contributed $150 per month, automatically transferred from our checking account. While college is years away, the power of compound growth means even modest contributions today can grow significantly by the time she enrolls. For example, at a 6% annual return, $150 per month over 18 years could grow to over $60,000. We didn’t expect perfection—market returns vary—but we trusted the long-term trend.

Our asset allocation also evolved. Before having a child, we were more aggressive, with a higher percentage in stocks. After her birth, we rebalanced to include more stability—increasing our bond allocation slightly to reduce volatility. This didn’t mean abandoning growth, but acknowledging our reduced risk tolerance. We now had someone else depending on us. Our investment strategy wasn’t about maximizing returns at all costs, but about achieving reliable growth while protecting against major losses. We reviewed our portfolio annually, making adjustments as needed, but avoided reacting to short-term market swings. Staying the course, even during downturns, was part of the plan.

Planning Ahead: Mapping Milestones from Diapers to Graduation

Children grow quickly, and their financial needs evolve just as fast. From diapers to driver’s education, from preschool to college applications, each stage brings new expenses. Instead of reacting to these costs as they arose, we built a forward-looking plan that anticipated major milestones and allocated funds accordingly. This proactive approach helped us avoid last-minute financial stress and ensured we were always moving toward our goals.

We started by listing key life events and estimating their costs. Infant care, early childhood education, extracurricular activities, health expenses, and college were all mapped on a timeline. We didn’t expect to predict every detail—childhood is unpredictable—but having a general framework allowed us to prepare. For example, we knew that full-time daycare would be our largest expense in the early years, so we prioritized saving for it during pregnancy. As our child grew, we adjusted our contributions based on changing income and new information.

We also segmented our savings into buckets: short-term (0–3 years), medium-term (4–10 years), and long-term (11+ years). Short-term goals, like emergency childcare or medical co-pays, were kept in liquid, accessible accounts. Medium-term goals, such as summer camps or music lessons, were invested in low-risk instruments like certificates of deposit or conservative mutual funds. Long-term goals, especially education, remained in the 529 plan with a growth-oriented mix. This tiered strategy allowed us to match each goal with the appropriate risk level and time horizon.

Annual reviews became a family ritual. Every January, we sat down with our financial plan, reviewed progress, and made adjustments. Did our income increase? Could we afford to save more? Did any unexpected expenses arise? These check-ins kept us accountable and flexible. Life rarely follows a straight path, but having a map—even one that gets revised—makes the journey less daunting. Planning ahead didn’t eliminate uncertainty, but it gave us confidence that we were prepared for what lay ahead.

Avoiding the Traps: Common Financial Mistakes New Parents Make

Even with the best intentions, new parents often fall into financial traps that can derail long-term progress. These mistakes aren’t signs of failure—they’re predictable responses to emotional and social pressures. Recognizing them early allowed us to avoid common pitfalls and stay focused on what truly mattered.

One of the most common mistakes is lifestyle inflation after a baby. While it may seem counterintuitive, some families spend more after a child arrives—not just on essentials, but on premium products, designer clothes, and unnecessary gadgets. The desire to give your child the “best” can lead to overspending on items that offer little real value. We were tempted too. But we learned to distinguish between wants and needs. A $200 stroller isn’t safer than a $100 one. Organic wipes don’t prevent rashes better than regular ones. By focusing on functionality over status, we saved thousands without compromising care.

Another trap is delaying saving and investing due to perceived lack of funds. Many parents tell themselves, “We’ll start when we earn more” or “We’ll save after the baby expenses settle down.” But waiting is costly. The earlier you begin, the more time compound growth has to work. Even $25 per month into a 529 plan adds up over 18 years. Delaying by just five years can cut the final balance by nearly a third. We started small, knowing that consistency mattered more than size.

Over-insuring is another risk. While adequate coverage is essential, some parents buy multiple overlapping policies or high-premium plans they don’t need. We avoided this by carefully evaluating each policy’s purpose and cost. We asked: Does this fill a real gap? Is the benefit worth the monthly expense? If not, we passed. Financial protection shouldn’t create its own burden. By staying informed and intentional, we built coverage that was sufficient, not excessive.

The Long Game: Raising Financially Healthy Families

True financial success isn’t measured solely by account balances or investment returns. It’s reflected in the values we pass on and the environment we create at home. Our goal isn’t just to leave our child a financial legacy, but to raise her with a healthy relationship with money—one rooted in responsibility, awareness, and balance. We believe that financial wellness is a family practice, not just an individual achievement.

From an early age, we’ve introduced simple money concepts. As she grows, she’ll learn about saving, giving, and spending through hands-on experiences—like using three jars for money gifts: one to save, one to spend, and one to share. These small lessons build a foundation of financial literacy. More importantly, we model the behaviors we want her to adopt. When we discuss a purchase, we talk through the decision. When we give to charity, she sees it. When we stick to a budget, she learns that limits aren’t restrictions, but tools for freedom.

This journey has never been about perfection. There have been months when we fell short, when unexpected costs disrupted our plans, or when we questioned whether we were doing enough. But we kept going. Progress, not perfection, has been our guide. We’ve learned that financial security isn’t built in a day, but through daily choices—small, consistent actions that compound over time, just like investments.

For other parents feeling overwhelmed, know this: you don’t need a perfect plan to start. You just need to start. Open a savings account. Review your insurance. Set up one automatic transfer. Each step, no matter how small, builds momentum. Parenthood brings new fears, but it also brings new purpose. And when that purpose is directed toward building a stable, secure future, the results go far beyond dollars and cents. They shape a home filled with peace, resilience, and love. That’s the real return on investment.